2023 Cyber Week Report

Melissa Dixon

2023 Cyber Week Report

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

For many, 2023 has been a year of economic uncertainty, shaped largely by enduring inflation, erratic gas prices, rising interest rates, and more financial challenges. As National Retail Federation (NRF) Chief Economist Jack Kleinhenz explained, “This year, a whole new set of dynamics is in place.”

As such, experts and analysts weren’t quite sure what to make of the holiday season. Whereas a recent report from YouGov predicted that 52% of shoppers would skip Black Friday, another survey by Deloitte showed that 66% of consumers planned to shop during Cyber Week.

Now that the dust has settled, the numbers paint a clear picture of a strong Cyber Week turnout fueled by online sales. According to Salesforce, shoppers spent a record $280.8 billion online, an increase of 6% from 2022.

BigCommerce customers, however, surpassed the broader industry benchmark with a marked increase of 10% in gross merchandise value (GMV) during the five-day period compared to Cyber Week 2022.

Additionally, BigCommerce customers experienced 100% platform uptime throughout Cyber Week for the tenth straight year, while BigCommerce support teams stood by 24/7 to assist during the busiest shopping days of the year.

BigCommerce CEO, Brent Bellm, expressed his enthusiasm:

“It’s gratifying to see BigCommerce customers perform well and benefit from our platform achieving 100% Cyber Week uptime for the tenth year in a row,” Bellm said. “Our open, simplified approach to enterprise ecommerce delivers the competitive advantage brands and retailers need to succeed around the world and across multiple sales channels.”

With all this in mind, we’ve put together a comprehensive 2023 Cyber Week report covering the five-day period from Thanksgiving to Cyber Monday, concluding our Cyber Week series of reports.

Read on for data insights into the macro trends and consumer behaviors BigCommerce has observed so far this holiday season.

Methodology

BigCommerce’s Cyber Week data is based on a comparison of year-over-year total platform sales metrics and represents the applicable period-on-period change that occurred November 24 – 28, 2022 and November 23 – 27, 2023. It contains information from thousands of brands and retailers selling on the BigCommerce platform. Unless otherwise noted, the data is global.

How Cyber Week played out

One way or another, the 2023 holiday season was going to be different from the last several years. While experts such as NRF are still predicting record spending for the holiday season at large, forecasts indicate slower growth rates between 3% and 4% in a return to pre-pandemic levels.

With consumer behaviors shifting almost daily and major retailers launching holiday sales earlier every year, the question became a matter of when consumers would do the bulk of their shopping — would Cyber Week still reign supreme?

We now have our answer: Cyber Week grew in response to the longer holiday shopping season.

From Thanksgiving to Cyber Monday, there was a double-digit increase of 10% in sales for BigCommerce customers compared to Cyber Week 2022. Additionally, shoppers were more active this year with a 7% increase in total Cyber Week orders, bolstered by a 3% increase in average order value (AOV).

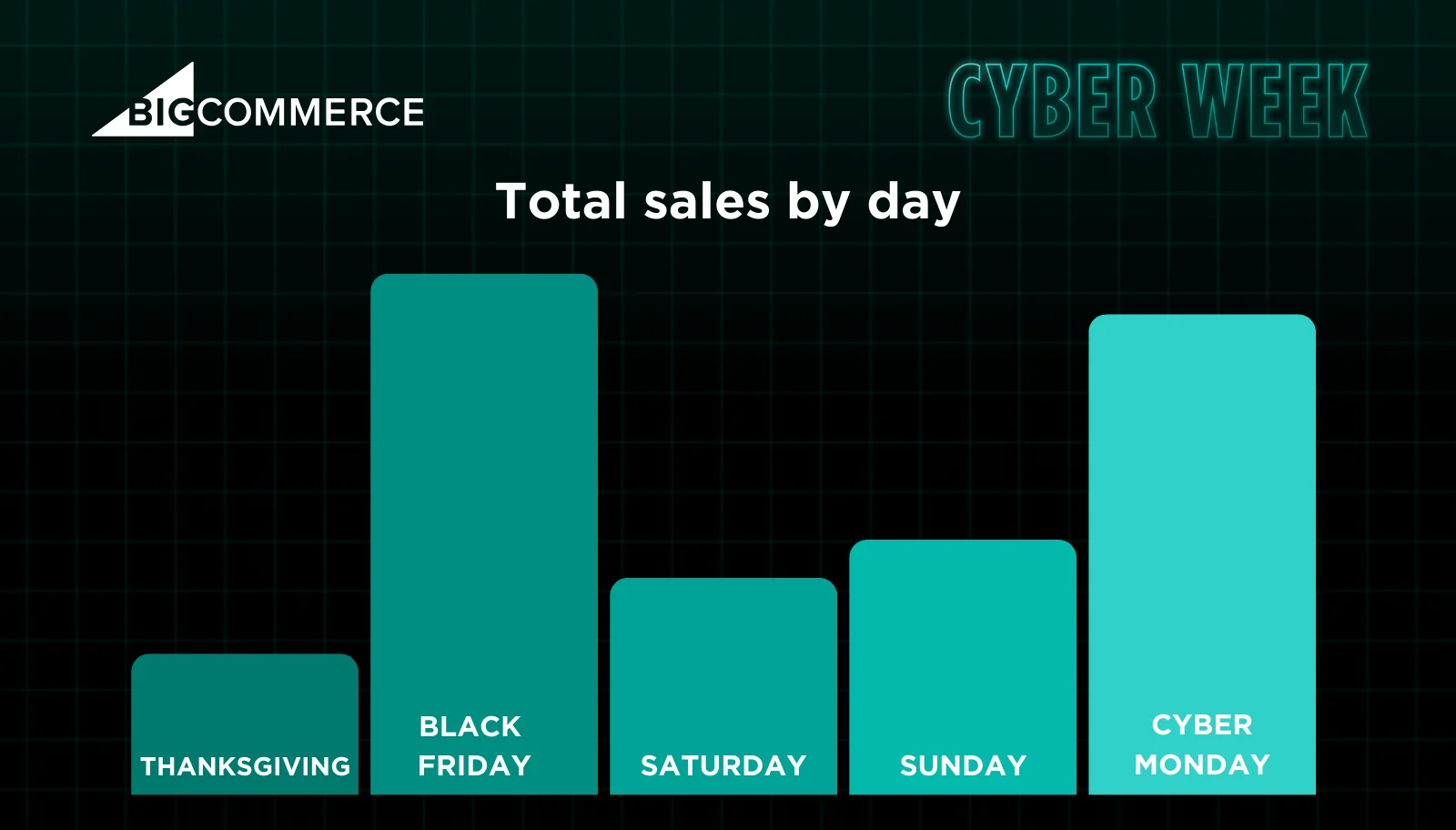

Looking closer at the daily shopping activity, BigCommerce customers started Cyber Week off with a bang, seeing a 12% increase in YoY sales on Thanksgiving Day, and the upward trend continued through the holiday weekend with steady increases in GMV, AOV, and orders.

Peak shopping times occurred from 2–3pm CT on Cyber Monday and 10–11am CT on Black Friday when shoppers placed the most orders for the week.

Black Friday and Cyber Monday stood out once again.

As expected, the two marquee days of Cyber Week accounted for the most sales of the week for BigCommerce customers.

When all was said and done, we saw an increase of 8% GMV YoY for Black Friday and an increase of 12% GMV YoY for Cyber Monday.

When comparing the two key shopping days this year, Black Friday was biggest in terms of total orders, Cyber Monday had the highest AOV of the week, indicating that shoppers spent more on their purchases.

Ultimately, Black Friday won out with the most overall sales for BigCommerce customers during this year’s Cyber Week.

Mobile and marketplaces made their mark.

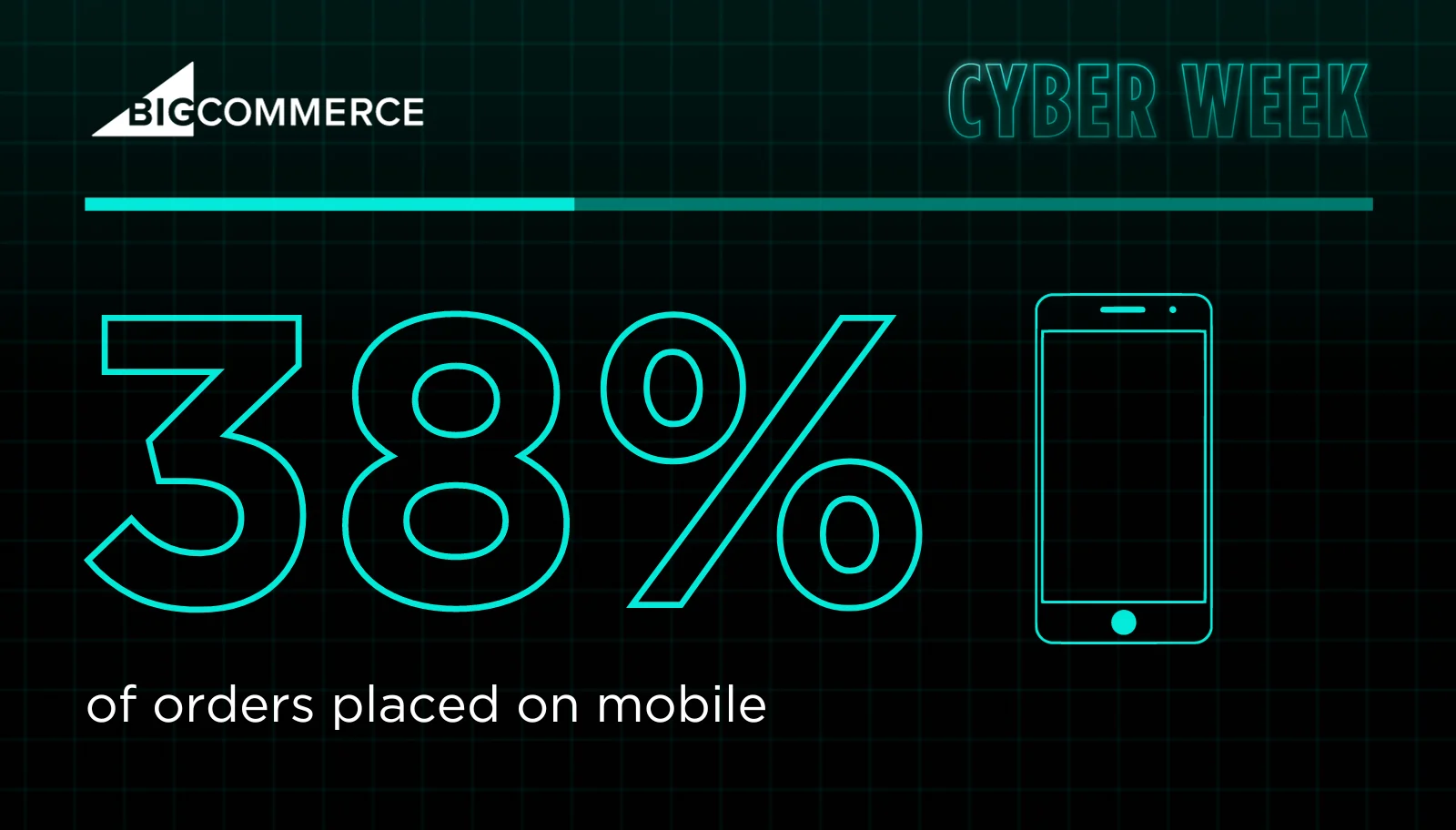

This year, mobile orders accounted for 38% of all Cyber Week orders, a slight increase from last year. Notably, however, the percentage of sales on mobile devices increased by a more substantial 13% in 2023, a clear reflection of the larger global m-commerce upward trend.

When it comes to channels, shoppers now have more options for holiday shopping than ever. For Cyber Week 2023, Amazon remained the standout among marketplaces with highest GMV and most orders for BigCommerce customers, followed in GMV by eBay and Walmart.

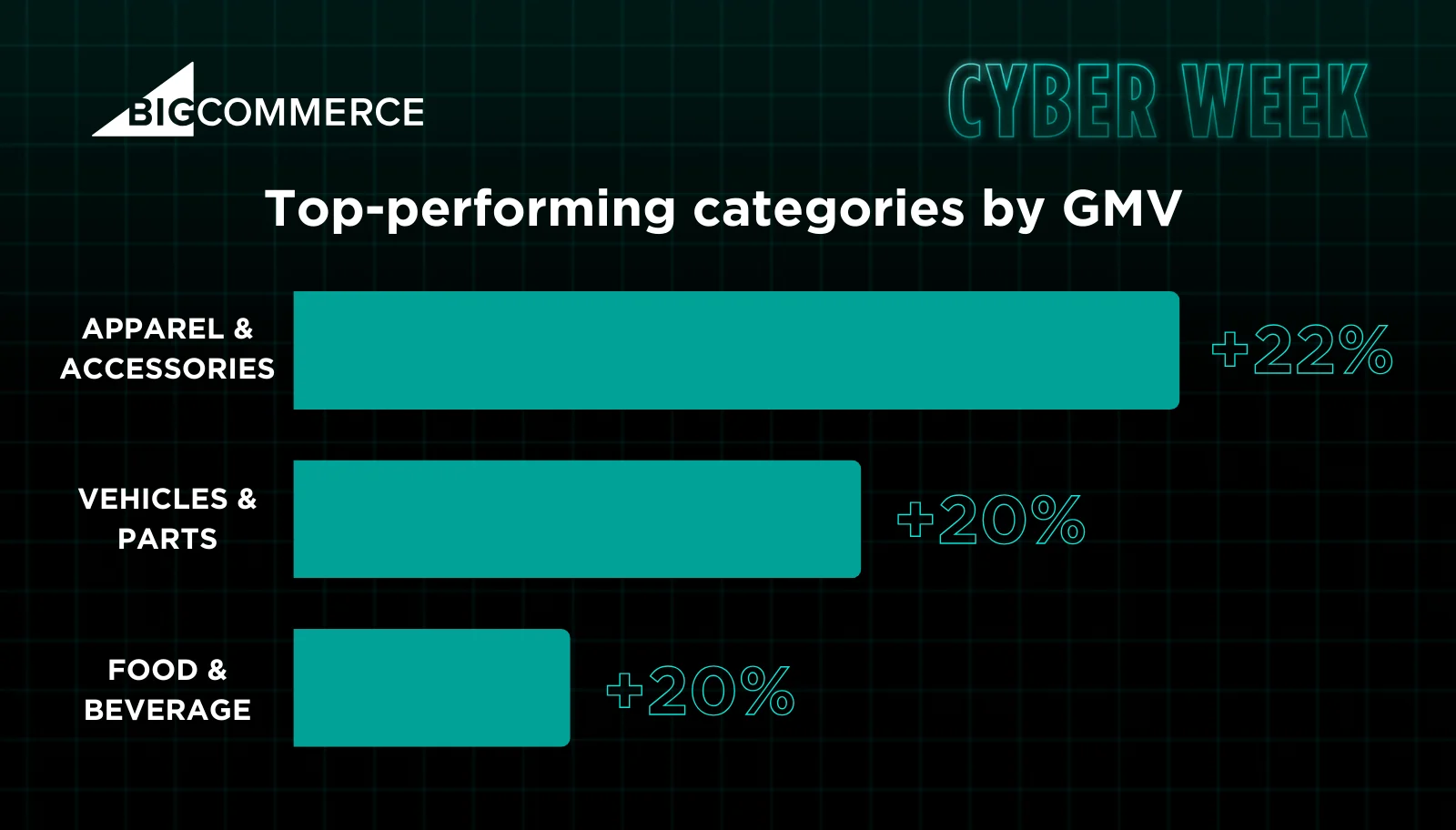

Top categories by sales for Cyber Week 2023.

The category with the largest growth in GMV YoY during Cyber Week 2023 was Apparel and Accessories with a 22% increase, followed by a tie between the Food and Beverage and Vehicles and Parts categories, which each experienced a 20% increase in GMV compared to last year.

Other high-performing categories this year include Arts and Entertainment, Hardware and Tools, Sporting Goods, and Luggage.

The final word

Cyber Week 2023 may have come and gone, but it has left a lasting impression — this year’s record-breaking ecommerce sales point to consumers’ and retailers’ resilience.

“Cyber Week closed with a 12% spike in year-over-year sales on Cyber Monday, signaling consumers’ urgency to capitalize on deep discounts before they were gone,” said Brent Bellm, CEO at BigCommerce. “Even with the holiday shopping season and retailer promotions starting earlier, these five days remain critical to retailers’ success. The 12% increase on Thanksgiving Day likely reflects that cost conscious consumers did their homework in advance — earmarking the exact items they want and then waiting for retailers to layer on early deals before pulling the trigger.”

For more Cyber Week insights, tune into our LinkedIn Live on Thursday, November 30.

Melissa Dixon is an accomplished content creator and people leader who has developed award-winning, original content programs for industry-leading brands. She is currently Director, Content Marketing at BigCommerce where she leads the company’s global content strategy, designed to educate and empower ecommerce businesses of all sizes.